The Sampada Group is a Holding company and is Regulated by Reserve Bank of India as Non Deposit taking Non Systematic Non Banking Finance Company. Various Subsidaries of the Group are regulated as required to conduct their business.

Our Business portfolio consists of 3 main segments Insurance Distribution , Insurance Staffing & Skill Development and Wellness.

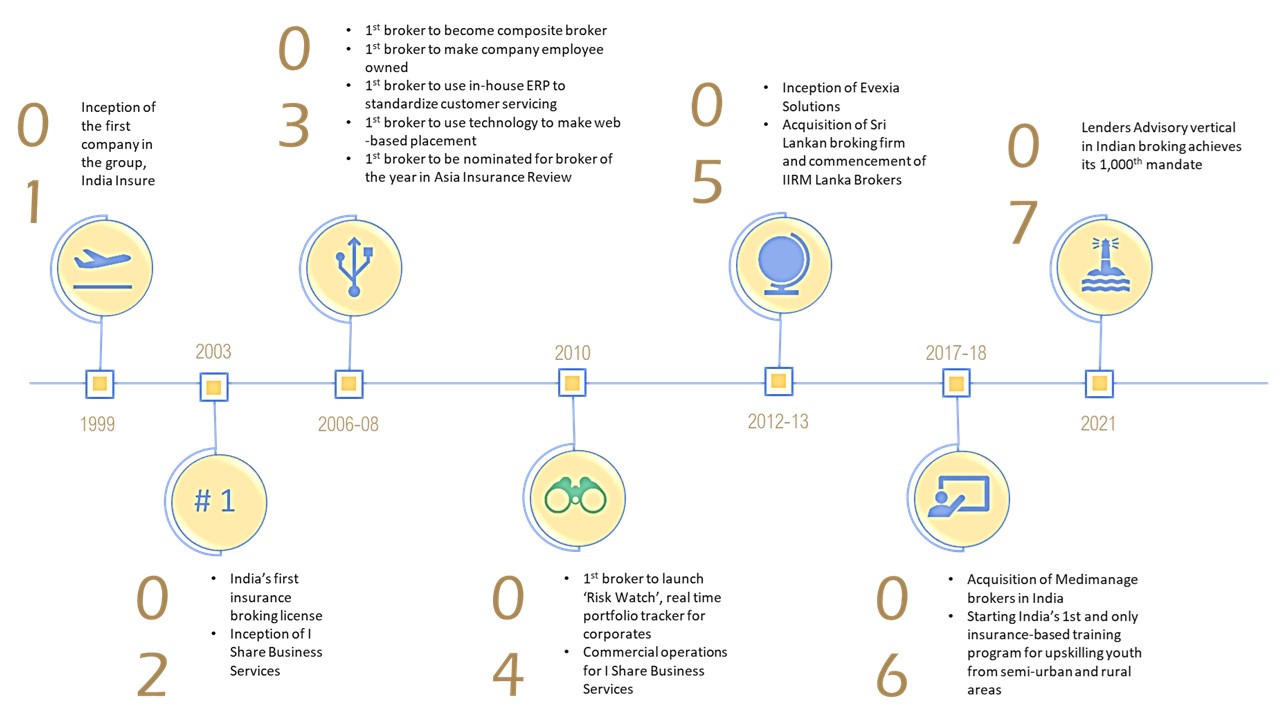

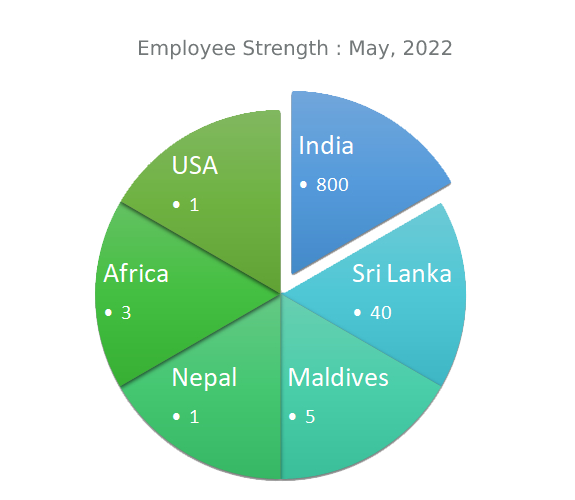

Samapda was incorporated in 1996 with a focus on The Insurance sector and Allied activities in the emerging markets of South Asia . The subsidiary companies operate in India, Singapore, Sri Lanka, Maldives and Nepal. The group returns a current turnover of US$ 14 million which is slated to reach US$ 40 million by 2026. The group has been a pioneer in many areas within the insurance vertical in the APAC region and has many ‘firsts’ to its credit. The promoters carry a large reputation in the insurance and related fraternity in all the countries they operate and have always believed in creating process driven long lasting organizations backed with up-to-date technology.