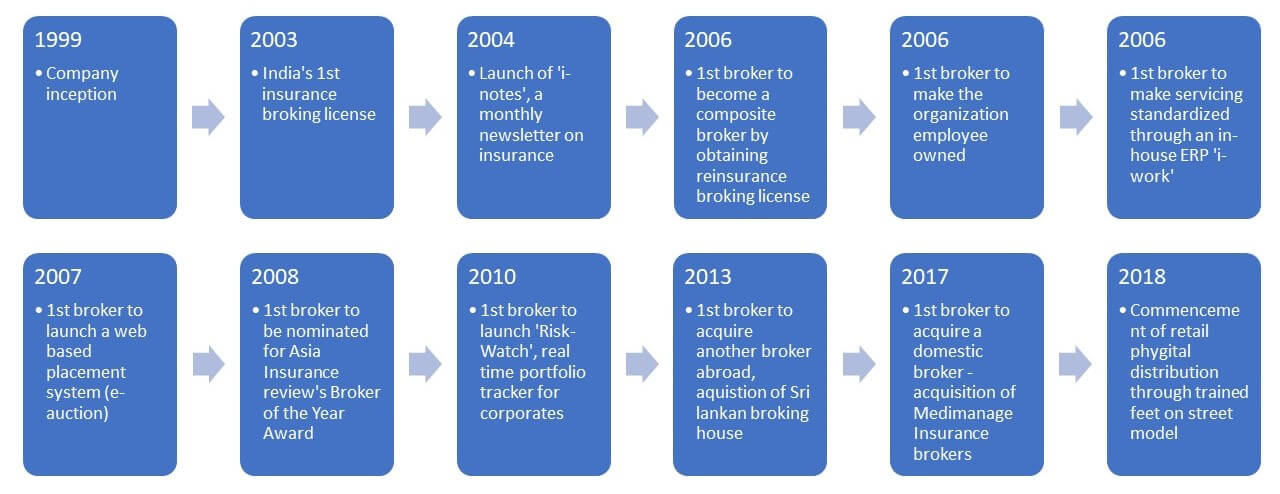

A pioneer in the Indian insurance broking industry, India Insure was set up in 1999 much before the advent of regularization of the insurance sector in India with the sole purpose of providing insurance consulting and distribution services. The company went ahead and acquired the very first insurance broking license of India from IRDAI and today is a full-service insurance distribution house operating in all lines of insurance distribution from commercial lines, employee benefits, specialty lines, lenders insurance advisors, retail lines to reinsurance broking. It has established itself as one of the leading insurance broker and as an organization known for its professional repute and high standard of ethics in domestic and international markets.

India Insure currently services around 1300 corporate customers (with a serviceable premium of USD 317 million) and 1.60 lakh retail customers (with a serviceable premium of USD 22 million), the reinsurance vertical manages a premium size of USD 25 million. It operates out of 9 offices across India apart from reinsurance operations handling in 15 countries. The company has formalized tie ups with THB of London and AMWINS of USA and has access to Lloyds London for reinsurance placements. India Insure also acquired Medimanage Insurance Brokers in the domestic market and Finlays Insurance Brokers in Sri Lanka and Maldives and have merged the operations.

The retail lines vertical operates in distributing insurance through the phygital model in semi-urban and rural markets in 3 states in the country, deploying over 500 trained manpower as feet on street. This model is being replicated to 12 states in coming future. An active worksite marketing model ensures that the corporate customers get a 360-degree experience with their employees also being personally guided for risk coverage options.

The brands Risk Watch and Insure Easy are part of India Insure’s service offerings to its customers.

India Insure operates through a designed process manual for every business process since 2006 and has linked rewards and penalties for process compliance. In addition, a dedicated internal audit / process compliance team ensures compliance.

IIRM Lanka was started as Finlays Insurance brokers and was the pioneer of Insurance broking in Sri Lanka. The company was started in 1893 and was acquired by Sampada Business Solutions in 2018. Since then, IIRM Lanka has grown substantially and has expertise in handling individual personal policies to large blue-chip corporates, covering all major industries in Sri Lanka, covering diversified companies in the market both horizontally and vertically.

IIRM Maldives is a subsidiary of IIRM Lanka and has a dedicated team focused on the Maldivian markets.

Both the entities do direct as well as re-insurance broking

The need for a providing trained manpower and back-office support services to the insurance sector prompted the birth of I-Share Business Services in 2003. The company started its commercial operations from 2010 and deploys handpicked and trained manpower in the areas of sales, marketing, claim processing, document processing, transaction processing, human resources, finance, accounts, information technology, compliance, analytics, MIS, enrolment, audit, call centre and administration across all lines of insurance services. The company also provides infrastructure and key connectivity operations services like servers, VPN, internet etc. by obtaining bulk discounts from vendors and benefiting its customers.

The fields of expertise of manpower trained and deployed ranges from qualified medical professionals, qualified accountants, experienced and qualified insurance professionals, qualified human resources specialists, experts in technology and coding, operational experts, process handling experts, communication and call center experts, data handling and analytics experts and administration experts.

The company has deployed over 1500 such experts over the past 5 years across all insurance segments and with various insurance services providers both in India and abroad, including, working independently with India’s largest general insurance company in managing over 40 million lives and handling an annual flow of 22 lakh health insurance claims making I-Share as one of the only such independent organizations in India.

I-Share is registered under MSMED Act and is an ISO 9001 Certified Company. In 2018, a unique training and deployment facility has been created within I-Share by operating India’s 1st and only insurance based training program for upskilling youth from semi-urban and rural areas under the Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDUGKY), a skill development programme of Central Government of India. The company operates exclusive licenses in 3 states in the India for this program and has so far trained and deployed about 500 people, all in the insurance sector. The company plans to broad base this program to 12 states in near future and train upto a 100,000 youth in the coming 5 years.

The company’s method of operation is to study the processes of the customers and then train young teams recruited to specialize in those processes and provide seamless professional service to the satisfaction of the customers.

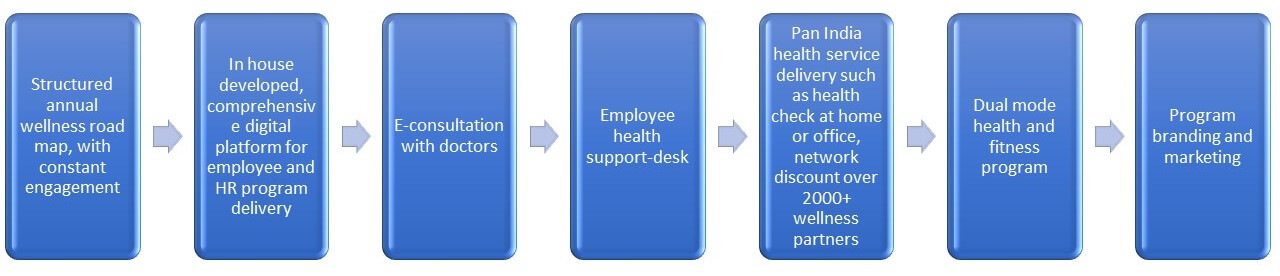

Evexia solutions started its commercial operations in 2012 as an in-house wellness services provider to the corporate customers of an insurance broking house. It later branched out as an independent organization with a unique service offering of practicing consulting based corporate wellness approach rather than a product-based solution.

Evexia today services over 25 clients across NBFC/banking, manufacturing, power and information technology sectors. Delivering over 1000 health check-ups and 50+ specialized activities every month spanning 2500 corporate employees through its 2000+ labs, diagnostic centres, family clinics, pharmacy and home collection agents network.

Business verticals of Evexia include on site health check-ups, offsite health check-ups, pre-employment health check-ups, retail health check-ups, specialized activities, doctor on call and consulting services. Recently the company has also launched a unique pre-packaged wellness card for the retail market which has insurance backed as well as non-insurance backed options.

Evexia offers its clients a highly insightful and structured wellness solution. Starting from designing the customized employee health management plan considering organization particulars such as demography, industry, diversity, claims precedence and attrition figures etc. We also ensure the program delivery is achieved at client premise by maintaining a network of wellness experts and partners across India. the objective is to offer each client employee an option to manage the health risk determined and evaluated post screening and health assessment. This has resulted in a 95% customer retention ratio over the years.

The unique value Evexia provides its client is to go beyond simplified causative analysis of broad risk groups of diabetic, HTN etc. We provide insights into overlapping comorbidity cohorts and also create a goal-oriented wellness program for each cohort. The approach allows us to deliver an impactful and truly customized wellness program.